Structure Tomorrow's Success: Just how to Save for College Expenditures

Achieving Financial Success in University: Practical Preparation Tips for Students

Browsing the monetary obstacles of college can be a difficult job for pupils. As tuition expenses continue to increase and living expenses include up, it is critical for students to develop useful preparation techniques to achieve economic success throughout their college years. From establishing economic goals to taking care of trainee financings, there are various actions that pupils can require to ensure they are on the right track towards a secure monetary future. In this discussion, we will explore some useful planning pointers that can help students make informed decisions regarding their funds, ultimately allowing them to concentrate on their scholastic pursuits worry-free. Whether you're a fresher just starting your university journey or a senior preparing to get in the labor force, review on to discover important understandings that can lead the way to financial success in college and past.

Setting Financial Goals

When establishing monetary goals, it is crucial to be certain and reasonable. Setting impractical objectives can lead to aggravation and prevent you from proceeding to function in the direction of financial success.

Additionally, it is vital to prioritize your monetary goals. Identify what is most crucial to you and focus on those objectives. Whether it is paying off pupil car loans, conserving for future costs, or building a reserve, understanding your priorities will assist you allocate your resources effectively.

Developing a Spending Plan

This might consist of cash from a part-time work, scholarships, or monetary help. It is vital to be sensible and comprehensive when approximating your costs.

Once you have actually identified your revenue and expenses, you can allot your funds as necessary. Consider alloting a portion of your income for savings and emergencies. This will help you develop a safeguard for unanticipated expenses and future goals.

Testimonial your spending plan regularly and make changes as required. This will certainly guarantee that your budget stays efficient and practical. Tracking your expenditures and contrasting them to your spending plan will assist you identify locations where you can cut back or make renovations.

Producing a budget plan is an important device for economic success in university. It permits you to take control of your finances, make informed choices, and job towards your economic objectives.

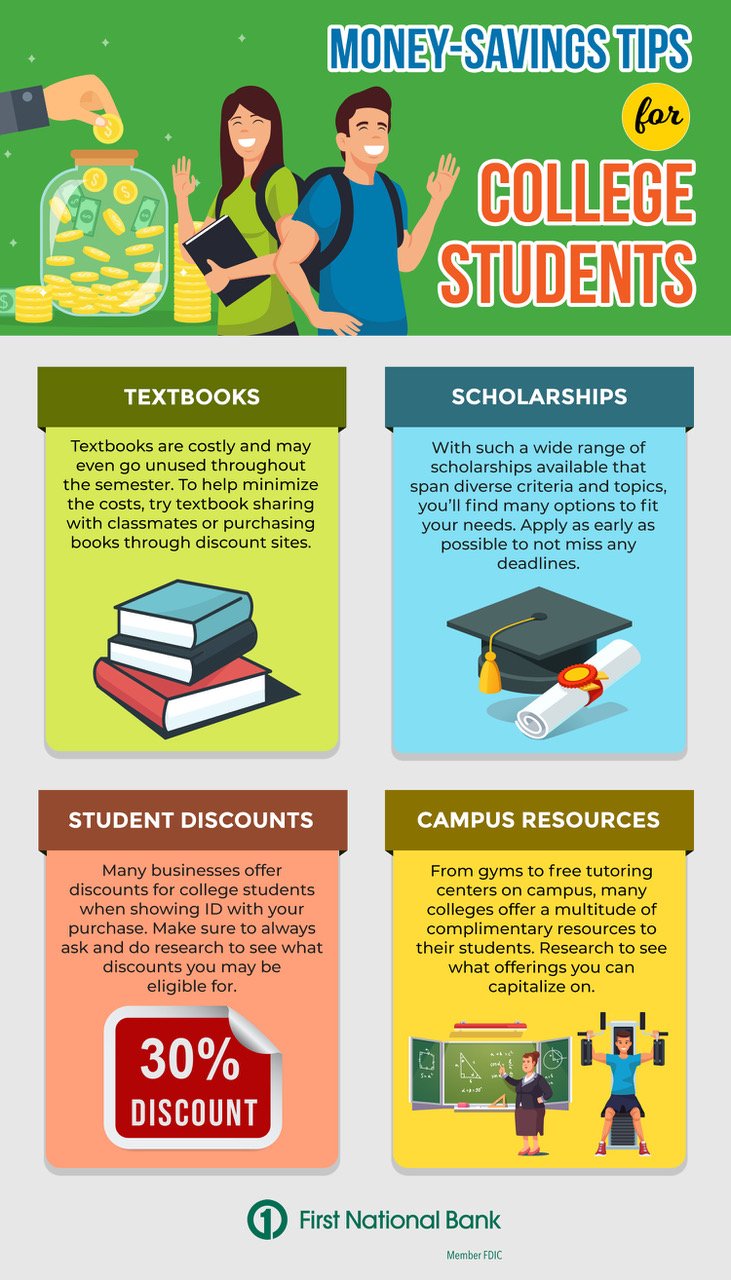

Making Best Use Of Scholarships and Grants

Optimizing gives and scholarships can dramatically relieve the financial concern of college expenditures. Grants and scholarships are kinds of financial assistance that do not require to be repaid, making them a suitable method for trainees to money their education and learning. Nonetheless, with the increasing cost of tuition and charges, it is essential for students to maximize their chances for gives and scholarships.

One way to take full advantage of grants and scholarships is to start the search early. Several organizations and establishments provide scholarships and gives to pupils, yet the application due dates can be months beforehand. By beginning early, trainees can research and apply for as several chances as possible.

Furthermore, trainees must thoroughly check out the eligibility requirements for each scholarship and grant. Some might have particular criteria, such as scholastic accomplishments, area involvement, or details majors. By understanding the requirements, students can customize their applications to highlight their strengths and boost their chances of obtaining financing.

Moreover, pupils need to think about looking for both nationwide and regional scholarships and grants. Regional scholarships commonly have less applicants, boosting the chance of receiving an award. National scholarships, on the other hand, may use greater monetary value. By expanding their applications, students can optimize their chances of protecting monetary aid (Save for College).

Taking Care Of Student Finances

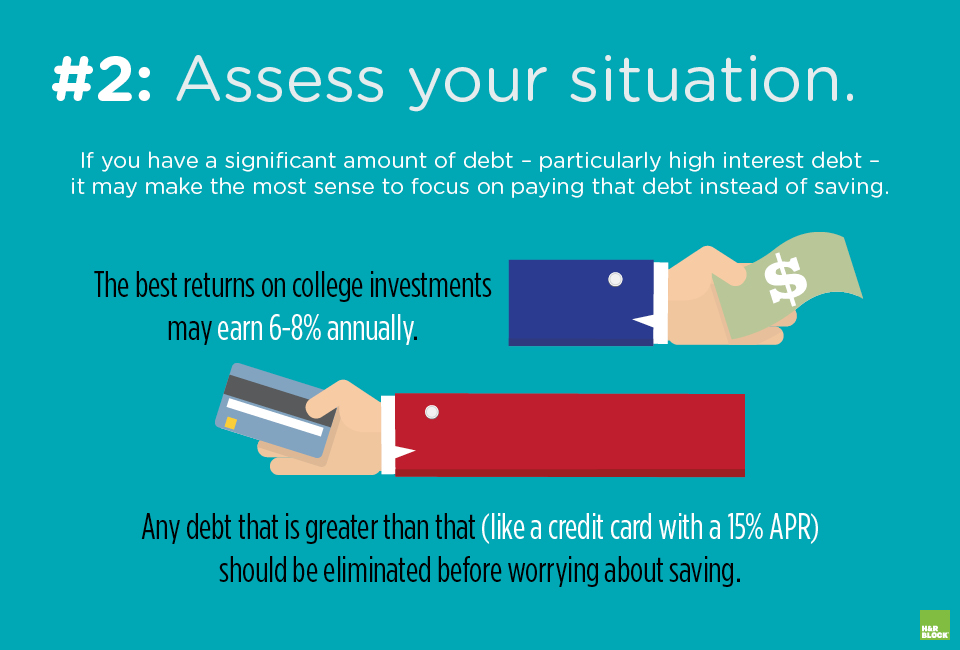

One essential aspect of browsing the economic obligations of college is efficiently handling pupil lendings. With the increasing cost of tuition and living costs, several students rely upon financings to money their education and learning. Mismanaging these finances can lead to long-term financial concerns. To prevent this, students need to take numerous steps to efficiently handle their trainee financings.

Primarily, it is very important to comprehend the terms and problems of the finance. This consists of understanding the passion rate, settlement duration, and any kind of potential charges or penalties. By being conscious of these information, pupils can plan their finances as necessary and stay clear of any shocks in the future.

Developing a budget plan is one more necessary action in managing pupil loans. By tracking earnings and costs, students can make certain that they allocate sufficient funds towards car loan payment. This also helps in determining locations where expenses can be lowered, enabling for more cash to be directed towards financing payment.

Additionally, pupils must check out options for financing mercy or repayment assistance programs. These programs can give alleviation for borrowers who are struggling click for info to settle their loans. It is necessary to research study and understand the qualification standards and needs of these programs to make the most of them.

Lastly, it is crucial to make timely finance settlements. Missing out on or delaying payments can cause extra fees, penalties, and negative effect on credit history scores. Establishing automated settlements or tips can assist guarantee that payments are made in a timely manner.

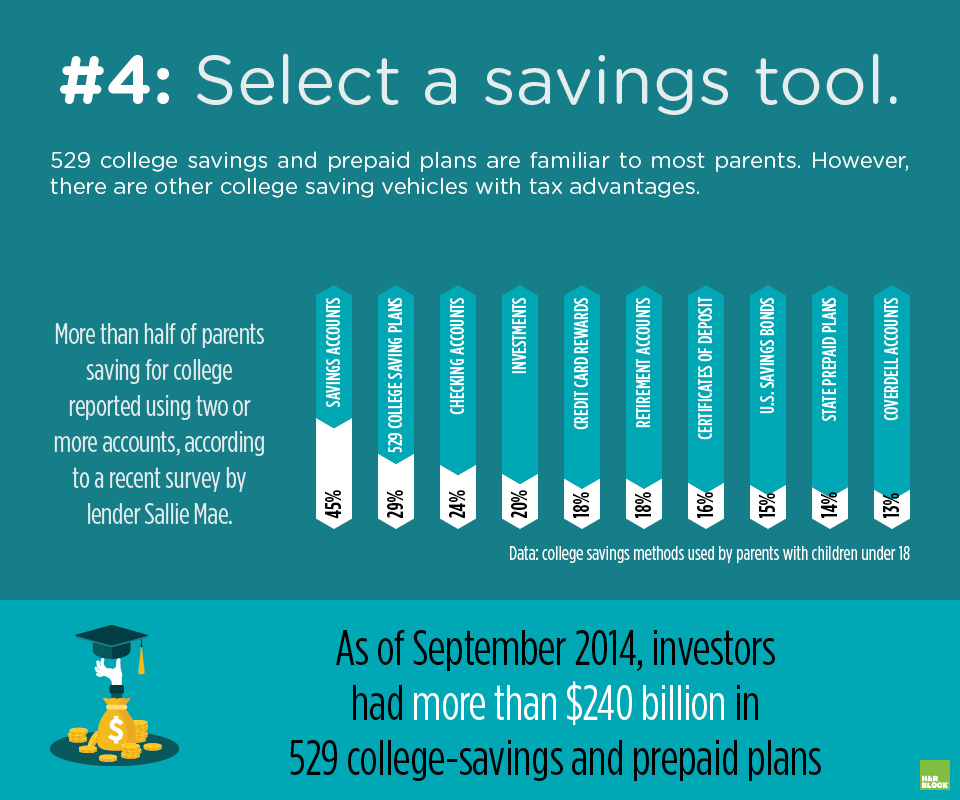

Saving and Spending Techniques

Browsing the monetary responsibilities of college, including successfully taking care of student lendings, establishes the structure for trainees to execute saving and investing methods for long-lasting economic success.

Conserving and spending techniques are essential for college pupils to secure their monetary future. While it may seem discouraging to start conserving and spending while still in university, it is never ever prematurely to begin. By executing these approaches early, pupils can benefit from the power of substance interest and build a solid financial foundation.

One of the primary steps in investing and conserving is developing a spending plan. This permits pupils to track their revenue and expenditures, recognize locations where they can reduce back, and allot funds towards cost savings and investments. It is essential to establish specific economic objectives and develop a strategy to accomplish them.

One more technique is to establish a reserve. This fund functions as a safeguard for unanticipated expenditures or emergency situations, such as clinical costs or auto repairs. By having a reserve, students can stay clear of going right into financial debt and keep their economic security.

Conclusion

To conclude, by setting monetary objectives, creating a budget plan, maximizing scholarships and gives, managing trainee loans, and executing conserving and investing strategies, college pupils can attain financial success during their university years - Save for College. Taking on these useful planning ideas will certainly help students establish accountable economic habits and Your Domain Name guarantee a much more safe future

As tuition prices proceed to rise and living expenses add up, it is important for pupils to create sensible preparation strategies to achieve financial success during their college years. From setting financial goals to managing student fundings, there are numerous steps that students can take to ensure they are on the best track towards a steady financial future.One important element of navigating the monetary obligations of college news is efficiently handling student car loans. To avoid this, students should take several actions to properly handle their trainee car loans.

Saving and investing techniques are important for college pupils to safeguard their monetary future.